Like the incredible shrinking man, intangible assets like a layout design, a good logo, a strong brand, or web applications suffer from accelerated depreciation in the internet sector. All growth industries where the market evolves and changes quickly have rapidly depreciating assets.

Whereas the design of an electrical transformer station depreciates to zero in ten to twenty years. Software, specially internet software has a much shorter life span, sometimes measured in months.

Knowing how much your assets depreciate is important. A typical NASDAQ company reinvests 5 to 20 times its asset depreciation to stay competitive. If you are reinvesting less than your depreciation, you are in trouble.

Formally, accounting standards depreciate software in three years. In reality, competitive forces in the internet sector can wipe our your software, your brand, your programming, your intangible asset, in as little as three months.

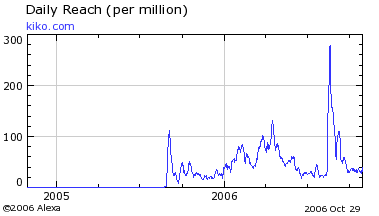

The Kiko example is a great a case in point. Its life cycle from conception to closure and asset sale, in a little over a year. Kiko was a web calendar application. Very popular as a complement to Google’s Gmail.com. Popular until Google launched its own Calendar application already integrated with Gmail. The graph shows the downward turn in summer 2006, and the spike corresponds to its delightful sale on eBay.

Today, the Pluck RSS reader, a very popular add on for Internet Explorer is shutting down ; it has been wiped out by Microsoft’s new browser, IE7, which has an RSS reader built in.

Accounting Standards

Accelerated depreciation is a self evident truth to all who work in the internet sector, but try and explain accelerated rates of depreciation to your company accountant. The other day I tried to get my accountant to introduce one year depreciation on all intangible assets in proximity to Google’s interest. Needless to say GAAP accounting standards were quickly brought to bear on such outrageous ramblings. So, we now have two balance sheets; one that keeps our accountants happy, the other a reflection of life in the fast lane. Guess which one we use to set company investment budgets ?

Covering the Incredibly Shrinking Value of your Intangible Assets: Capital and Ideas

You need two things to fight accelerated depreciation, capital and ideas. A rare combination, in my opinion. Many Venture Capitals have much of the first, and little of the second. Startups have much of the second and little of the first.

In my opinion, ideas are much harder than capital. The value of capital is decreasing rapidly. When it comes to your capital expenditure, good ideas create more value than a sterile pot of money. When shoring up the depreciating value of your intellectual property look to a creative class team, rather than your MBA graduate.

The classical Venture Capital administrator, adept at forming teams and putting together good startup administration is finding life harder and harder. Know-how and innovation talent is the new king in growth industries; if you have no ideas, better give the capital back to your shareholders or limited partners. Pity there is no Master’s accreditation for Creative Talent – Master in Business Creation (MBC). MBC is the new MBA.

[Via Pluck RSS Reader Shuts Down: Consumer RSS Readers a Dead Market Now]