The American Association of Advertising Agencies (AAAA) is creating an electronic platform for trading ads across media. The Association is bowing to the inevitable and modernizing ad space buying and selling.

Advertising agencies have historically leveraged their personal relationships, privileged access to clients and media, and poor price and inventory information to generate large buy-sell margins. The practice of end of year kick-backs from media publishers to ad wholesalers to ensure continued patronage is still rampant.

Incumbent agencies and institutions will fight to retain their place and margin in the value chain, in spite of the dis-intermediation alternatives.

“The world is changing faster than we can keep up with it,” said Ray Warren, president of ad agency Carat Media Group Americas.

“Phones will still work….It’s just a way to communicate electronically.” said Peggy Green of ad agency Zenith Media USA.

Electronic trading is the natural solution for such inefficient markets. AdECN, an independent trading exchange platform for advertising is already online. Google and eBay are deploying the private marketplace platforms into adverting media buy and selling. Google is introducing radio ads onto its Adwords platform, in addition to ads in magazines, and ads in newspapers.

eBay, in turn, has its private marketplaces; eBay Media Marketplace is to go live in a few weeks. While marketers like Lexus, Hewlett-Packard, Microsoft and Home Depot are participating in eBay Media marketplace, no cable networks have signed on yet.

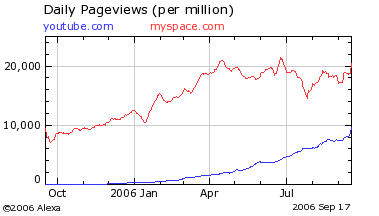

As ever, volume on these trading exchanges is an all or nothing proposition; community of buyers and sellers tip from one market platform to another en mass. Similar migration of buy/sell volumes have been occurring between trading exchanges in the financial market since the first electronic exchanges appeared in the 1990s.

I lived through just such a loss of trading volume while at the London Financial Futures and Options Exchange during the mid-1990s; 30% of our trading volume deserted from our trading pits onto Frankfurt’s electronic trading platform. The automated platform fees were 10% of our trading fees and the buy/sell spread margins were narrower. Our response was to close the open-outcry trading pits with their 3000 colourful pit traders, and launch a competing electronic exchange, CONNECT (TM).

The only alternative left to media agencies is to own and host the new electronic marketplace.